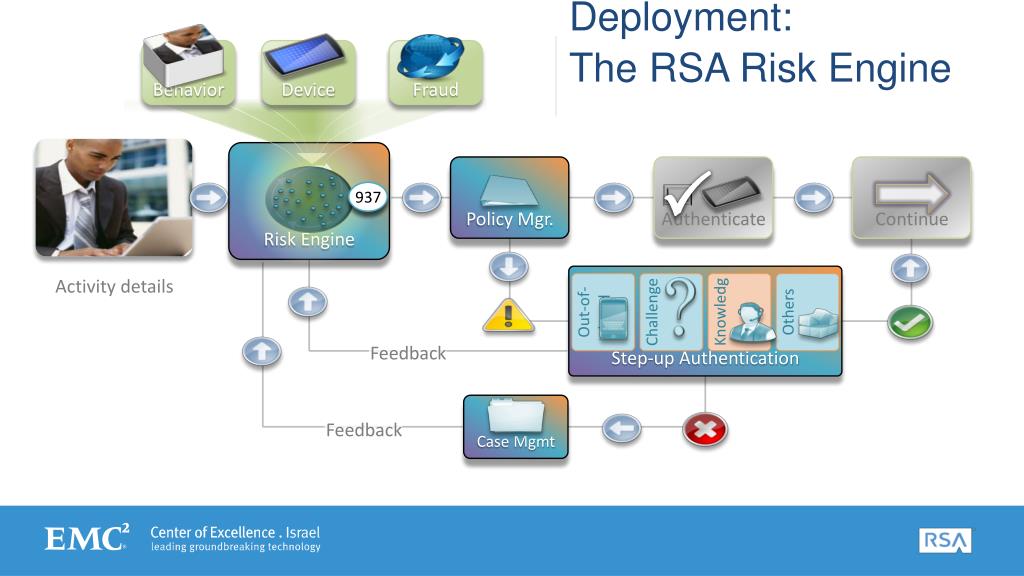

Dell had previously acquired RSA as part of its purchase of EMC in 2016. Device & Behavior Profiling, RSA eFraudNetwork, Step-up Authentication. The spinout comes less than a year after private equity firm Symphony Technology Group (STG), which recently bought FireEye’s product business for $1.2 billion, acquired RSA Security from Dell Technologies for more than $2 billion. cross-channel protection, including the RSA Risk Engine, RSA Policy Management. In addition, Adaptive Authentication uses the RSA Risk Engine to estimate the level of risk for the specific activity and uses information collected from. RSA, meanwhile, will continue to focus on integrated risk management and security products, including Archer for risk management, NetWitness for threat detection and response and SecureID for identity and access management (IAM) capabilities. Our role as a revenue enabler for the global economy will only strengthen as every digital business continues to scale.” As the digital economy continues to deepen, the Outseer mission to liberate the world from transactional fraud is essential. Outseer says its product portfolio is supported by deep investments in data and science, including a global network of verified fraud and transaction data, and a risk engine that the company claims delivers 95% fraud detection rates.Ĭommenting on the spinout, Taussig said: “Outseer is the culmination of decades of science-driven innovation in anti-fraud and payments authentication solutions. Outseer will continue to operate under the RSA umbrella and will inherit from the company three core services, which are already used by more than 6,000 financial institutions: Outseer Fraud Manager (formerly RSA Adaptive Authentication), a risk-based account monitoring service 3-D Secure (formerly Adaptive Authentication for eCommerce), a card-not-present and digital payment authentication mapping service and FraudAction, which detects and takes down phishing sites, dodgy apps and fraudulent social media pages. Led by CEO Reed Taussig, who was appointed head of RSA’s Anti-Fraud Business Unit last year after previously serving as CEO of ThreatMetrix, the new company will focus solely on fraud detection and management and payments authentication services.

as well as its sophisticated analyst toolset, forensic capabilities and reporting engine.

RSA Security has spun out its fraud and risk intelligence business into a standalone company called Outseer that will double down on payment security tools amid an “unprecedented” rise in fraudulent transactions. RSA NetWitness Platform aligns business and security risks.

0 kommentar(er)

0 kommentar(er)